This blog sheds a light why UK buyers are slowing down their property purchases. For many years, the UK was the largest group of foreign buyers in Spain, especially along the Costa del Sol, Costa Blanca, and Canary Islands. However, recent data shows a significant decline in activity. Understanding why requires looking at economic, regulatory, and currency factors, as well as shifts in buyer priorities.

According to the General Council of Notaries, UK buyers completed 6,048 property transactions in 2024, making them the largest foreign nationality. (Idealista)

In 2025, UK nationals purchased 5,731 homes, representing 8.1% of all foreign property purchases. (Idealista)

Brexit and Residency Challenges

The UK leaving the EU has had a major impact on property purchases. UK buyers now face stricter residency and travel rules, including the 90/180-day Schengen limit and more complex residency permits. Changes in healthcare and tax rights also affect long-term stays, making ownership of a second home less straightforward.

Learn more about international property investment in Türkiye

Higher Taxes for Non-EU Buyers

UK nationals now face higher taxation in Spain. Non-resident rental income is taxed at 24% for non-EU citizens, with fewer deductions than EU nationals. Spain has also considered additional property taxes for non-EU buyers, potentially up to 100% in some cases. (ThinkSpain)

Currency Risk

The weakening of the British pound against the euro has reduced UK buyers’ purchasing power. Properties that once seemed affordable in GBP now appear significantly more expensive. Exchange rate volatility adds further uncertainty for multiple purchases.

Economic Pressure in the UK

High inflation, rising interest rates, and mortgage costs have limited disposable income for overseas property investment. Many UK buyers are now postponing purchases or focusing on fewer, high-value properties instead of volume.

Administrative and Legal Frictions

Post-Brexit bureaucracy has increased: legal paperwork, financing, and notary requirements. Political and regulatory uncertainty creates caution among buyers, particularly for second homes.

Changing Buyer Profile

UK buyers remaining in the market tend to invest in luxury or high-value homes rather than multiple holiday properties. Popular regions include Andalusia, Murcia, and the Canary Islands. They are more selective, focusing on long-term value and rental potential. (Idealista)

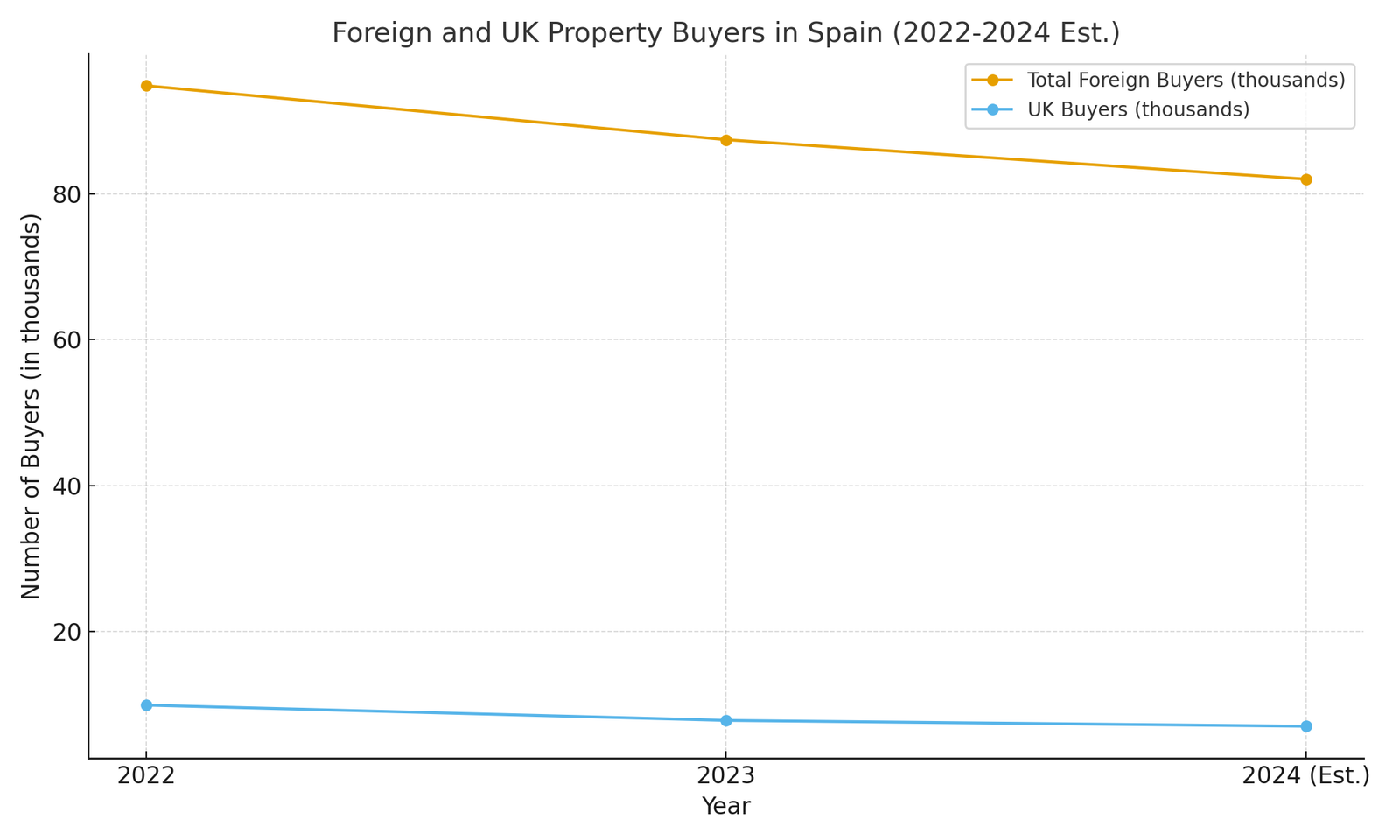

Backed by Data: What the Numbers Say

- UK nationals made 6,048 purchases in 2024, the largest foreign buyer group. (Idealista)

- In the first half of 2025, UK buyers purchased 5,731 homes, about 8.1% of all foreign property purchases. (Idealista)

- In 2024, foreign buyers purchased nearly 93,000 properties in Spain, with UK buyers among the top nationalities. (Idealista)

What Investors Should Consider

- Evaluate alternative markets: Given regulatory and tax uncertainty, UK buyers may find more stable returns elsewhere.

- Focus on due diligence: Verify local rules, tax obligations, and ownership structures.

- Use expert advisors: Real estate agents and lawyers can help navigate cross-border complexities.

- Diversify your portfolio: Don’t rely only on Spanish property — consider other European markets like Türkiye for growth potential.

📞 Contact us today to explore your options.

🌐 Website:https://havenlyhomes.uk

📞 Phone: +44 7453 651226

📧 Email:info@havenlyhomes.uk

Join The Discussion